Is The Section 179 Deduction For You?

Have you heard of the Section 179 tax deduction? Most businesses have and although it's not for everyone, some businesses can see a real advantage in putting the Section 179 deduction to work for them. The U.S. government initiated the deduction as a way to encourage business owners to invest in their companies. But what exactly does the deduction do?

Section 179 allows companies to write off the entire purchase price of goods used in the running of a business because in many cases the purchased equipment had reached the end of its useful life by the time it had been fully written off.

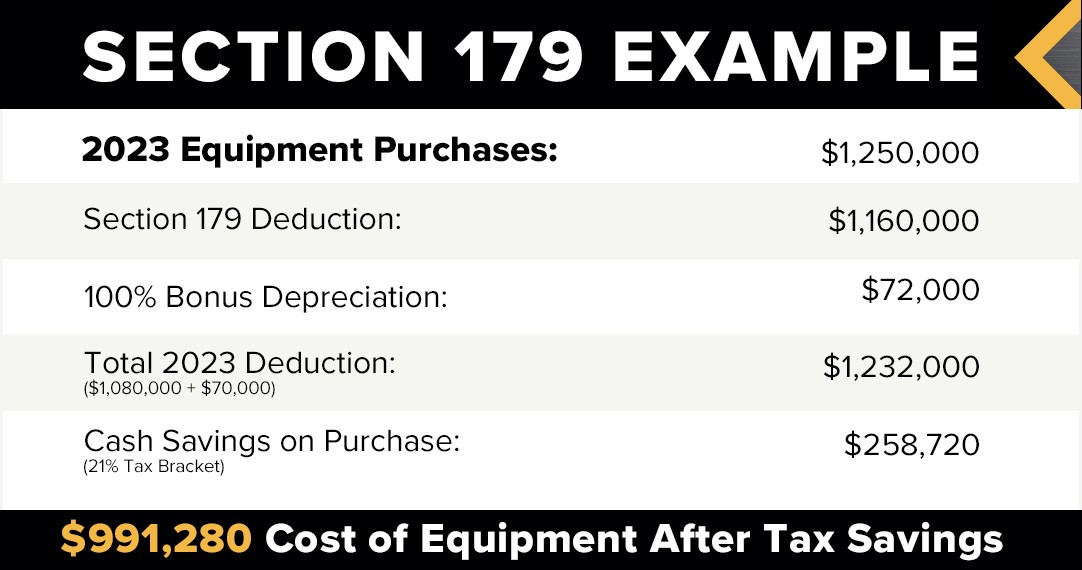

Due to inflation, the Section 179 deduction and phase-out limits increased for 2023. The limit for qualifying equipment purchases is $1,160,000, and the phase-out threshold is $2,890,000 this year.

There is a lot of leeway in what purchases qualify for the Section 179 deduction. In the material handling industry, many – if not most – pieces of equipment such as lift trucks, reach trucks, order pickers, pallet jacks, container handlers and much more qualify.

That equipment can be new, used or leased/financed, but if buying a used piece of equipment, it must be "new" to the company – in other words, "first use" by the business. Bonus depreciation for 2023 is 80% for equipment placed into service from January 1, 2023, through December 31, 2023.

One of the guidelines for Section 179 is that the piece of equipment must be purchased between Jan.1 and Dec. 31, 2023 and placed in use in the business.

It is important to take into account in the material handling industry is the availability and deliverability not just the purchase timeframe.

There are qualifiers to the Section 179 deduction. Nonetheless, Section 179 can be very beneficial to many companies who need to make equipment purchases for their operations.

If you've been considering purchasing or financing a new or used piece of material handling equipment and want to look into the possibility of making the Section 179 deduction work for you, consult with your CPA or tax advisor to see if the Section 179 tax deduction is right for your company.

The clock is ticking on year end. Contact Darr today for more information on new and used material handling equipment in inventory that may qualify for a Section 179 tax deduction or bonus depreciation.